Sale Leaseback Helps a PE-Backed Biotech Company Prepare to Sell

CSC provided short-term liquidity to keep a biotech company humming while they prepared to sell the business.

Challenge

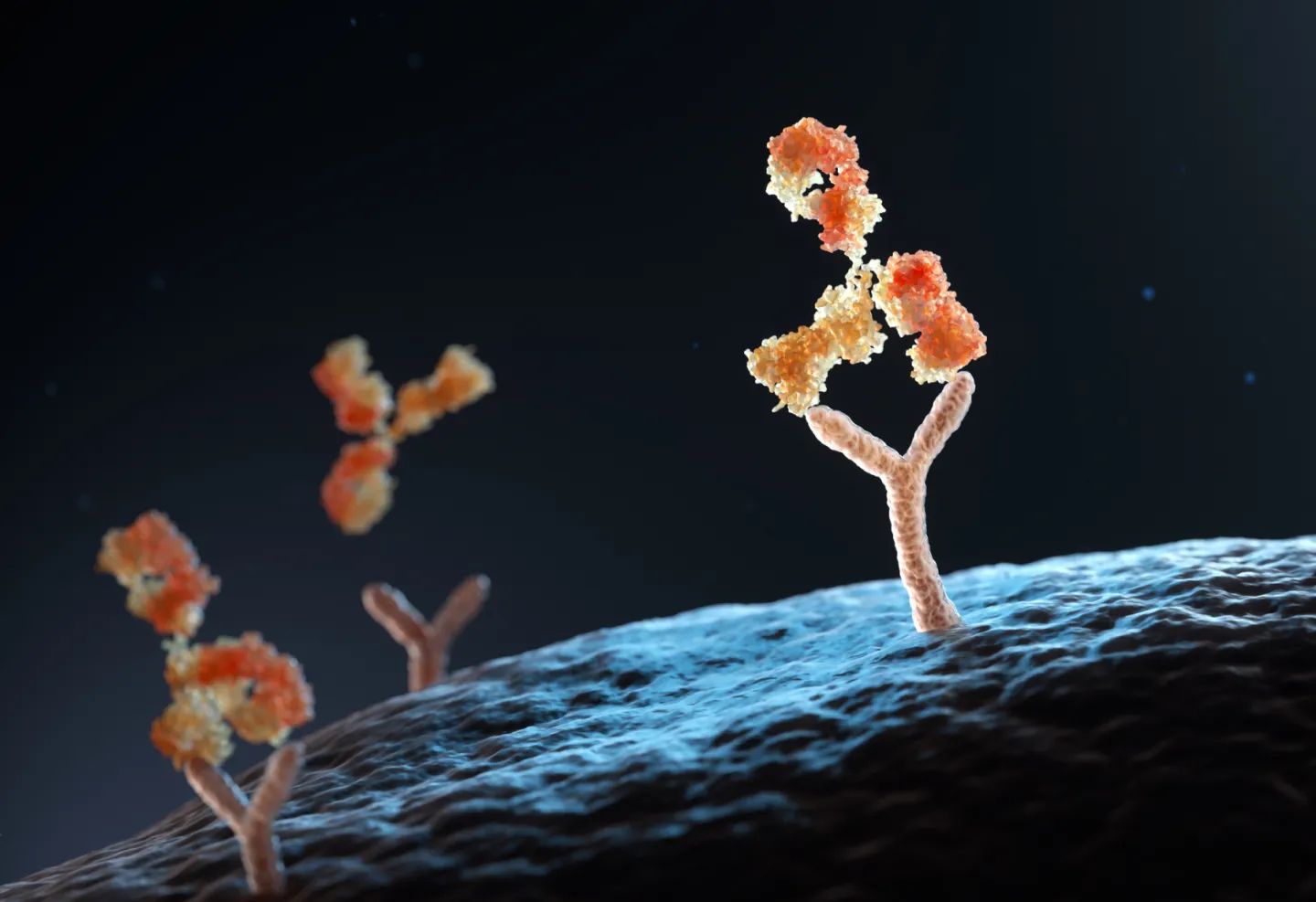

A company that specializes in the development and manufacturing of antibody-drug conjugates is navigating significant changes, including selling existing manufacturing facilities and potentially the entire business.

After building a fourth facility, the company was cash strapped. The private equity sponsor had invested more money in the build than originally planned, so additional funds weren’t readily available. The company required short-term liquidity to keep the business humming until they could sell off the other facilities or the entire business.

Solution

CSC provided a sale leaseback on $44 million of the original asset cost and provided an advance rate of $20 million.

Results

A sale leaseback from CSC has allowed the private equity sponsor to pad the balance sheet in the event the sale of the business takes longer than expected. The company is either going to leave the $20 million in the company or distribute it to shareholders to keep them happy.

- Maintained ownership with non-dilutive financing

- Increased cash flow with predictable payments

- Preserved availability on other debt facility

- Experienced a simpler, more flexible financing process

- Improved asset management with CSC’s customizable, web-based portal

- Simplified — vendor agnostic— procurement

Benefits

By partnering with CSC, the organization is realizing these benefits:

- Lease lines to $50 million

- Predictable payments spread out over several years

- Vendor agnostic

- Simple, flexible underwriting process

- Customized solutions

- Non-dilutive financing with no covenants or warrants

- Full-service procurement services

- End-to-end asset management